Today, Finance continues to remain one of the least digitized functions in any organization. Even with the advent of multiple specialized tools in this domain, the realized value falls short as they work disparately, leading to challenges in maintaining several platforms (and in turn, several SOPs) in executing an end-to-end transaction leading to closure.

A siloed approach in Spend Management often results in the following challenges:

- A broken user experience in shifting across multiple tools with limited exchange of context.

- Challenges in onboarding and managing compliance parameters and configurations across several tools in the organization's financial ecosystem.

- Executing numerous integrations to ensure end-to-end flow of data, from source to value.

- Difficulties in ensuring organization-wide adoption of these tools, which is more prominent in Enterprise-scale companies.

The problem of fragmentation requires an integrated approach to connecting the dots in realizing value across the source-to-pay journey. At Dice, we have strived to dive deeper and identify the building blocks that empower any financial ecosystem.

The result: A connected ecosystem that helps bring key stakeholders together through integrated portals, and facilitates the exchange of information through flexible and versatile modular blocks.

Let's understand some fundamental concepts that have guided our vision throughout the journey so far.

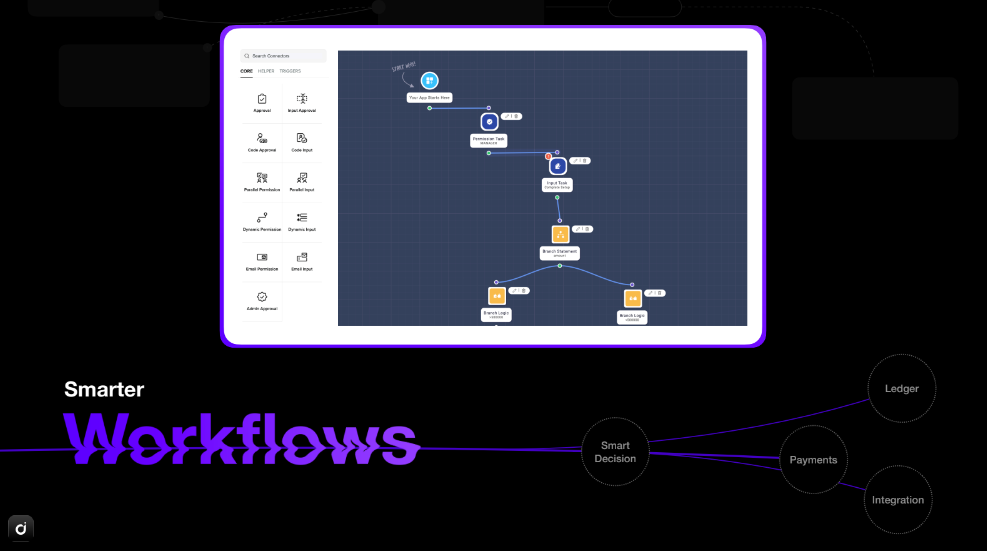

Dice offers a top-of-the-line workflow builder that enables companies to create and streamline processes at any scale and at any moment. With this feature, users can easily design finance or procurement workflows of any kind, and can even integrate payments and third-party services into their processes. Additionally, the process engine is capable of interacting with the ledger and accounting components, which allows it to make logical decisions and ensure the accuracy of your financial data.

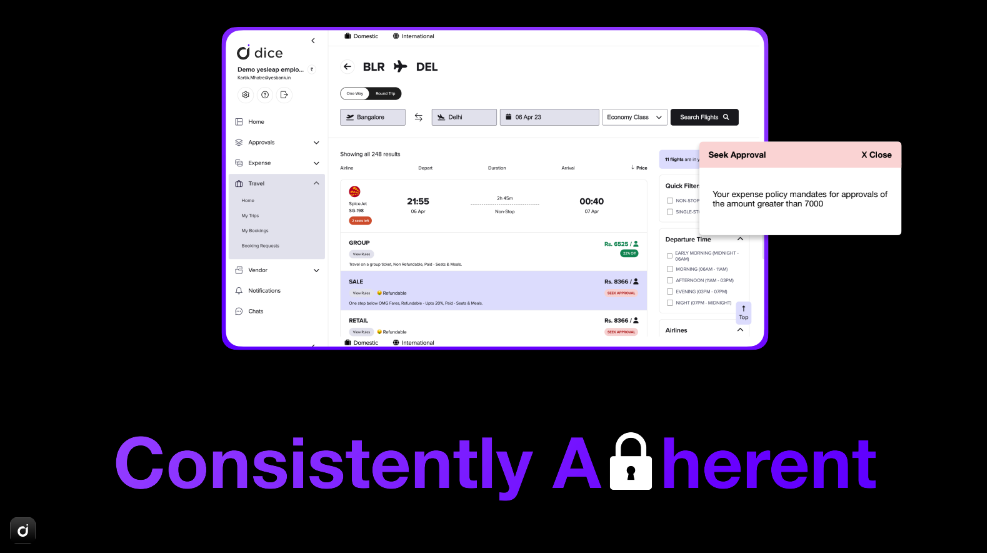

The compliance engine is designed to handle both internal and external compliance requirements. Internal compliance refers to the rules and policies set up to manage employees, vendors, and budgets. This could include policies related to employee reimbursements, vendor payments, expense approvals, and budget allocations. External compliance refers to the various regulations set by the government, such as GST (Goods and Services Tax), TDS (Tax Deducted at Source), and other policies. The compliance engine ensures that all spending activities are monitored, tracked, and approved based on these policies.

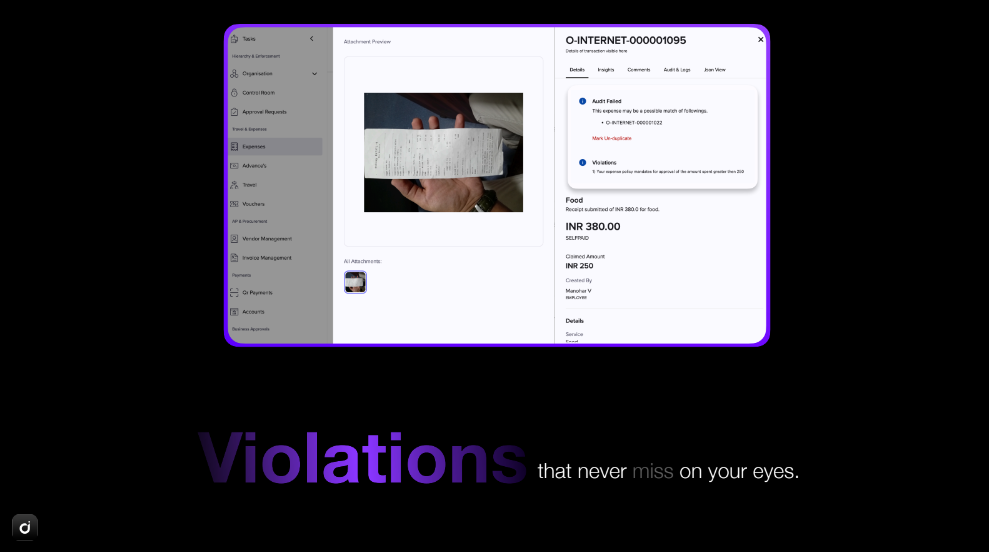

Dice offers real-time auditing capabilities through its best-in- class OCR technology. The OCR system automatically scans receipts and invoices to detect any fraudulent or duplicate claims. This helps businesses comply with relevant regulations and policies while providing real-time insights into their expenditures. In addition, the system maintains a digital audit trail of all financial transactions, allowing the auditing engine to provide businesses with a comprehensive overview of their spending. This enables businesses to identify areas where cost reductions and efficiency gains can be achieved.

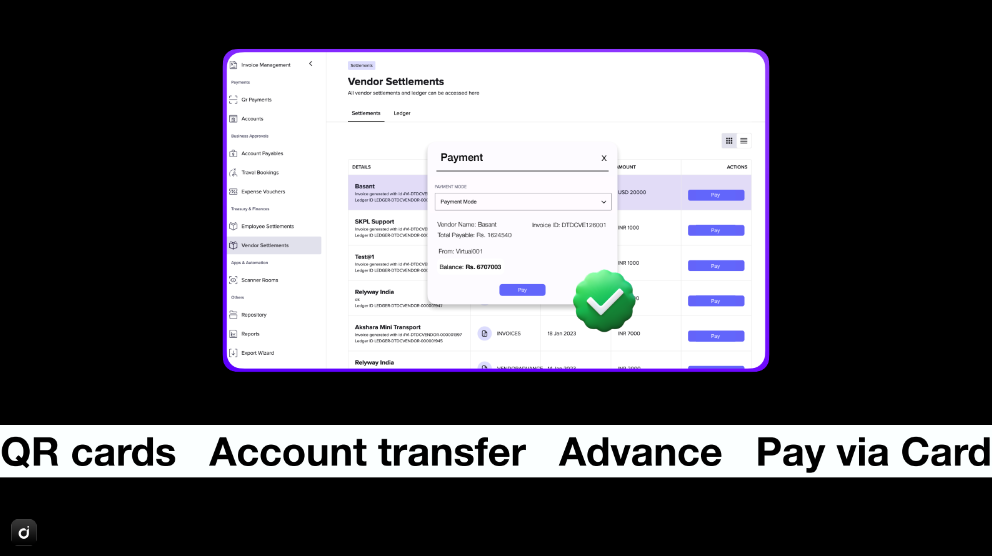

By integrating with multiple banks and the Neo bank, the Dice payment engine allows businesses the flexibility to pay via multiple modes. With connected banking, users can enable all the transactions from the current account itself thus maintaining a trail for each transaction within the platform. By integrating with the UPI stack we are able to deliver just-in-time funded QR payments that happen in real-time.

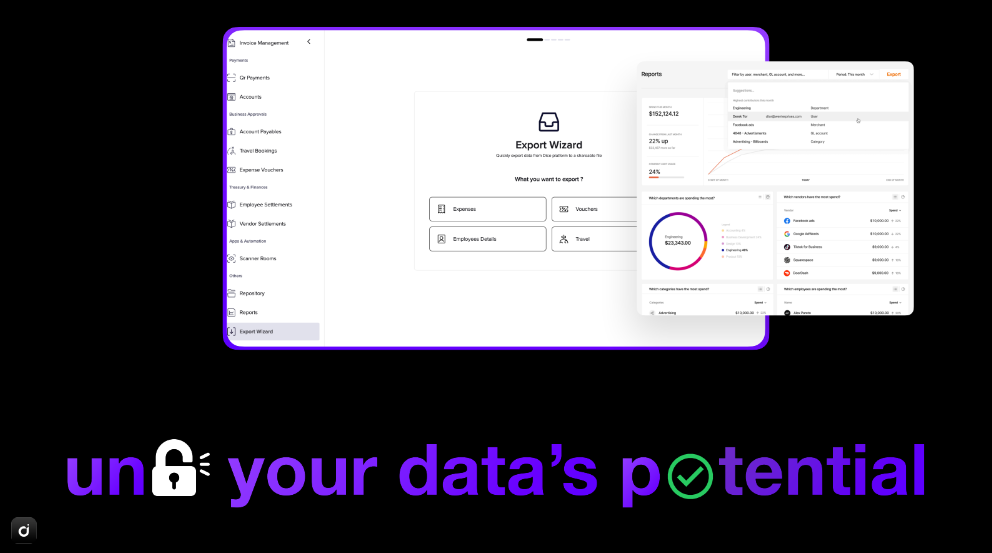

The Dice integration engine acts as a central hub for pulling and pushing data from various third-party apps, such as HRMS, accounting tools, and ERP systems. This process ensures that all relevant data is synced to and from the system, creating a global integrator for data management. Additionally, the platform includes a reporting engine that can generate dynamic or static system reports in real-time. These reports can be shared instantly with stakeholders, providing critical insights for decision-making.

In addition to the underlying engines, a digital engine acts as a wrapper that manages all the dashboards and renders the front-end experience for users to interact with the system. This engine plays a crucial role in providing a seamless and intuitive user experience, allowing users to easily navigate the platform and access critical information. The digital engine is responsible for managing the user interface and experience, including the design, layout, and functionality of the platform. It enables the creation of custom dashboards that can be tailored to specific user needs and preferences, ensuring that users have access to the information they need to make informed decisions.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article